Rent and utilities could appear under administrative, while advertising costs could be listed under Fundraising. Each statement helps nonprofits remain financially sound; however, individuals must understand how to read the reports to receive maximum benefit. With well-documented procedures, nonprofits can provide the transparency that the IRS requires https://www.bookstime.com/ to ensure funds are being properly managed. Nonprofit accountants must stay updated on these changes to ensure ongoing compliance. Nonprofits must make the most of every dollar received, and accountants often need to get creative to stretch funds as far as possible while still complying with donor restrictions and regulatory requirements.

Five Tips for Successful Grants Management

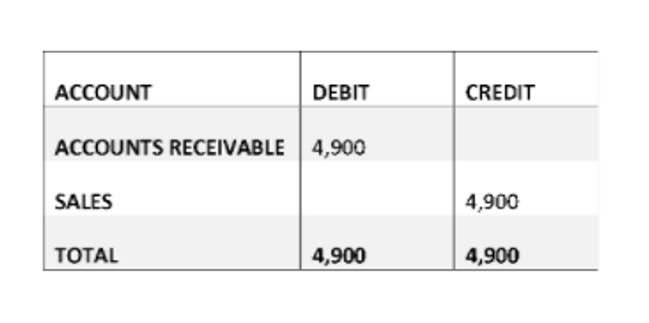

You would set up expense accounts to represent and track the different ways you spend money (i.e. groceries, rent or mortgage, fuel). All companies have a choice of two accounting methods — cash or accrual. Nonprofits may opt for cash because it seems simpler, but accrual may be the best choice, especially if funding sources include grants or endowments. Showing expenditures allows board members to determine if the administrative costs are out of balance compared to program expenses.

Organization

Proper accounting and financial management are necessary for nonprofit organizations to stay viable and remain accountable to the public, donors, funders, and other stakeholders. The delegation also helps alleviate leadership of day-to-day accounting tasks and allows them to focus on other organizational objectives. government and nonprofit accounting is crucial for any organization that relies on donations and grants to fulfill its mission, not just those without revenue. Nonprofit accounting ensures your organization uses its financial resources effectively to move your mission forward. Public viewpoints on overhead expenses hurt the nonprofit industry a great deal.

Overview of Applicable Laws and Regulations

Learn the key differences between between these two entities to ensure your organization is classified correctly. Her work has been featured by business brands such as Adobe, WorkFusion, AT&T, SEMRush, Fit Small Business, USA Today Blueprint, Content Marketing Institute, Towards Data Science and Business2Community. Instead of a “Balance Sheet”, which a for-profit business would be required to generate, a nonprofit would instead issue a “Statement of Financial Position”. Nonprofit accounting shares much in common with for-profit accounting, but there are some key distinctions that nonprofit entities need to keep in mind.

Education and Skills Required as a Nonprofit Accountant

The primary guidelines your organization should know about are the GAAP standards. Fund accounting enables nonprofits to allocate their money into different groups or “funds” in order to keep them organized and only spend funds on what they’re designated for. However, that paperwork, number crunching, and other tedious tasks come with the territory of running an effective nonprofit organization. One such activity that many nonprofit professionals don’t want to deal with is nonprofit accounting. When you first started working at your nonprofit, what entranced you? Chances are, it wasn’t tedious paperwork, challenging calculations, and compliance regulations.

How much will you need each month during retirement?

With so many accounting software packages to choose from, there’s no reason for nonprofits to track donations manually. A third individual records the donations in the accounting system, ensuring that the amount recorded matches the deposited amount. The board of directors reviews the financials to avoid the possible mishandling of donations. With adequate controls in place, nonprofits can comply with the IRS transparency requirements.

Implement checks and balances internally

- DonorPerfect automatically generates personalized acknowledgment letters and receipts for contributions.

- A well-organized Chart of Accounts is critical for accurate financial reporting and analysis.

- A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

- Nonprofits must abide by the laws concerning taxes, filing deadlines, and any other applicable regulations that pertain to their special tax status.

- It helps to illustrate how cash flows in an organization and cash balance changes over time.

You can check out Bloomerang’s accounting consulting recommendations to find other accounting firms that can help you build out your nonprofit’s financial management strategies. Your statement of functional expenses enables you to allocate your expenses according to their use at your organization. Essentially, it classifies your expenses according to your use of your organization’s funds. Essentially, this statement will organize and categorize your expenses and revenue sources. This report also allows your organization to analyze the changes in your net assets throughout the year.

0 Comments