Fintech is no longer just a buzzword within banking and finance—it’s a transformative force across multiple sectors. As financial technology continues to evolve, businesses beyond traditional banking are increasingly tapping into custom fintech software development to streamline operations, enhance customer experience, and drive innovation.

From insurance and real estate to e-commerce and healthcare, various industries are leveraging tailored fintech solutions to meet their unique financial and operational needs. In this article, we’ll explore how different industries are benefiting from custom fintech software development, and why this trend is gaining momentum across the business landscape.

What is Custom Fintech Software Development?

Before diving into the industries, let’s define the term. Custom fintech software development refers to the process of building tailor-made financial technology solutions that align with the specific goals and workflows of a business or sector. Unlike off-the-shelf products, custom solutions are designed from the ground up, offering greater flexibility, security, scalability, and functionality.

These solutions can include features such as payment processing, digital wallets, lending platforms, financial analytics, blockchain integrations, automated invoicing, and much more—developed precisely to fit a company’s requirements.

1. Insurance (Insurtech)

One of the most prominent non-banking sectors utilizing custom fintech software development is the insurance industry—often referred to as Insurtech. Insurance companies are adopting digital platforms to simplify underwriting, claims processing, fraud detection, and customer engagement.

How Custom Fintech Solutions Help:

- Automated policy management and claims processing

- AI-based risk assessment and fraud prevention

- Seamless digital payment and premium collection systems

- Customer self-service portals and mobile apps

By leveraging custom fintech tools, insurers can reduce operational costs, accelerate claim settlements, and offer a more personalized customer experience.

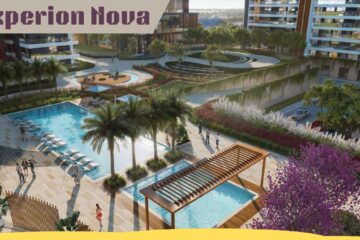

2. Real Estate and Property Management (PropTech)

The real estate sector is embracing custom fintech software development to manage complex financial transactions, tenant payments, mortgages, and investment portfolios.

Key Benefits:

- Automated rent collection and expense tracking

- Digital mortgage application and approval systems

- Smart contract implementation using blockchain

- Investment platforms for fractional ownership and REITs

These innovations are not only streamlining back-office operations but also enhancing transparency and trust among property buyers, tenants, and investors.

3. E-commerce and Retail

Fintech is revolutionizing the e-commerce and retail sectors, enabling businesses to offer flexible payment methods and manage finances more efficiently. Custom fintech software empowers retailers to integrate payment gateways, track sales analytics, and manage customer credit.

Fintech Features in Retail:

- Buy Now, Pay Later (BNPL) integration

- Multi-currency payment systems

- Digital wallets and loyalty programs

- AI-based pricing and financial forecasting

By investing in custom fintech software development, online retailers can boost conversion rates, simplify checkout processes, and improve customer loyalty.

4. Healthcare and Medical Billing

The healthcare industry faces significant financial challenges, from insurance reimbursements to patient billing. With custom fintech software development, healthcare providers can automate financial workflows, enhance payment security, and offer patients more flexible billing options.

Use Cases:

- Medical billing and claims automation

- Integrated payment systems for patients

- Healthcare financing and lending solutions

- HIPAA-compliant fintech platforms

Custom fintech tools help reduce administrative overhead and improve patient satisfaction by making healthcare payments more manageable and transparent.

5. Education and EdTech

Educational institutions and EdTech platforms are exploring fintech to manage tuition payments, scholarships, donations, and student financing. Custom fintech software development enables schools and learning platforms to create secure, scalable financial systems for their stakeholders.

Examples of Fintech in Education:

- Automated tuition billing and installment plans

- Financial aid management platforms

- Student loan servicing tools

- Digital wallets for school payments and campus activities

With tailored fintech solutions, educational institutions can improve financial accessibility and streamline back-office operations.

6. Logistics and Transportation

The logistics and transportation sector involves complex payment structures including freight billing, fuel reimbursements, and vendor payments. Fintech is helping companies manage these financial workflows with greater efficiency and transparency.

Fintech Benefits:

- Automated invoicing and freight payment systems

- Fleet financing and leasing platforms

- Real-time expense tracking and analytics

- Cross-border payment solutions

Custom fintech software allows logistics companies to better manage cash flow and reduce financial friction across supply chains.

7. Hospitality and Travel

Hotels, airlines, and travel agencies are integrating custom fintech software development to simplify bookings, manage payments, and provide financing options to travelers.

Features in Travel Fintech:

- Dynamic pricing engines

- Integrated payment gateways

- Travel insurance and financing options

- Loyalty and rewards payment systems

These solutions enhance user convenience, increase booking rates, and open new revenue streams for hospitality providers.

8. Legal and Professional Services

Law firms and professional service providers often deal with complex billing cycles and client payment processing. Custom fintech software development enables these businesses to implement better financial control, client invoicing, and trust account management.

Solutions Include:

- Automated time tracking and billing

- Payment portals for clients

- Retainer and escrow management

- Compliance-ready financial reporting tools

Such fintech innovations can significantly improve the client experience while ensuring regulatory compliance.

Conclusion

It’s clear that the impact of custom fintech software development extends well beyond traditional banking. From streamlining operations to enhancing customer experience and enabling new business models, fintech is unlocking value across various industries.

As businesses seek more control, flexibility, and innovation in financial operations, tailored fintech solutions are emerging as a game-changing investment. Whether you’re in real estate, healthcare, education, or retail—custom fintech software can give you the competitive edge you need in today’s fast-evolving digital economy.

0 Comments