E-invoicing would be a radical shift in the way the country views digital financing and economic growth. Part of the Vision 2030 program, e-invoicing features jointly designed modernized financial and business infrastructure in Saudi Arabia for a more streamlined economy with more transparency and efficiency. Looking for ways to improve efficiency and operational agility, e-invoicing, or electronic invoicing as it is known, is believed to achieve this in both businesses and government entities. It is indeed an effective improvement in the application of technology to the processors from paper to paperless billing because it should be migrated to electronic invoicing reducing all administrative burdens and keeping the economy thriving.

E-invoicing in Saudi Arabia is not only convenience-related, but also contributes to a new shift in the extent of transparency and compliance in commercial interactions that are fundamental to developing trust in the transactions and integrity of the latter. By providing a business real-time and reliable data, e-invoicing can significantly boost firms’ financial decision-making, bolster their tax reporting, and encourage collaboration between the private and public sectors. Technology and finance work together as one unit, resulting in improved business operations and a stronger foothold in the global economy. Thus, e-invoicing forms part of Saudi Arabia’s deepening commitment to digital integration and automating her processes toward a future economy that is technologically advanced and sustainable.

Here Is Why E-Invoicing Is A Must For Saudi Businesses

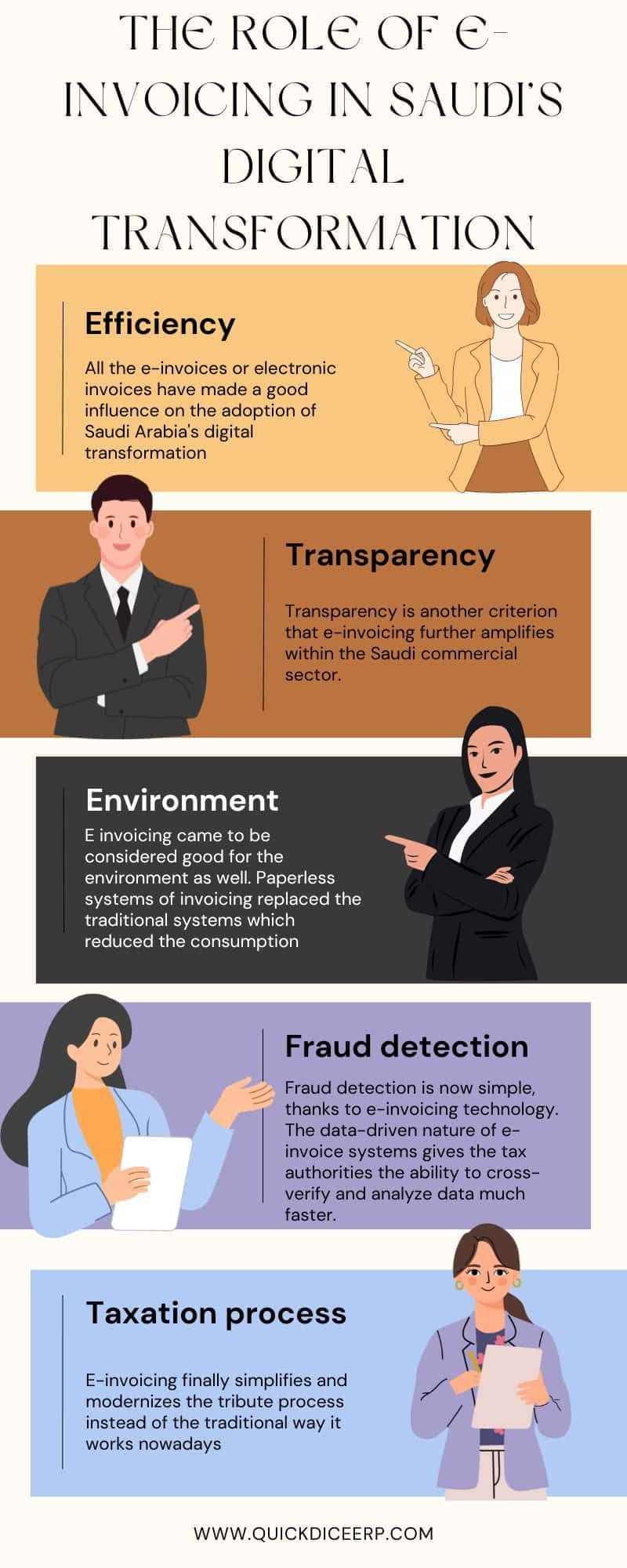

1. Efficiency.

All the e-invoices or electronic invoices have made a good influence on the adoption of Saudi Arabia’s digital transformation, embracing modernization and ultimately improving the economic terrain. It manifests both in business operations and in its governance since it incorporates the grand vision of a digital economy within the country’s Vision 2030 initiative. One of its most prominent facets is that it nurtures efficiency. E-invoicing automates invoicing processes, which would largely reduce the chances of manual errors as well as unburden administrative personnel and streamline financial operations. This advantage translates into lesser time taken for payment cycles and reduced cost of operations; it becomes beneficial not only to the individual business but to the economy as a whole. Moreover, systems that enable automation process transactions faster and more accurately, hence improving financial forecasting and decision making.

2. Transparency

Transparency is another criterion that e-invoicing further amplifies within the Saudi commercial sector. The shift from traditional paper invoices to electronic formats has made every transaction easier to track, record, and audit. This real-time visibility means businesses and tax authorities can access and check records at any time-giving rise to better oversight and accountability. As a result, e-invoicing has become a very effective instrument for tax compliance, helping the government to verify business activities with high precision and collect taxes as required. It also brings in its other aspect: prevention from tax evasion, which may be very common in cash or manual systems.

3. Environment

E invoicing came to be considered good for the environment as well. Paperless systems of invoicing replaced the traditional systems which reduced the consumption of paper in business transactions. It lowers consumption for the manufacture of paper. Also, it reduces the carbon emissions and waste associated with it as a part of moving along the world in sustainability and eco-friendliness. Thus, e-invoicing saves energy consumed for storage and physical handling of paper documents and thus reduces and cuts down costs that are needed for filing and the maintenance of physical records.

4. Fraud detection

Fraud detection is now simple, thanks to e-invoicing technology. The data-driven nature of e-invoice systems gives the tax authorities the ability to cross-verify and analyze data much faster. Therefore, it would be much easier to determine inconsistencies and unusual patterns that would arouse suspicion of fraud processes or even attempts to avoid the statutory compliance. However, the main advantage of e-invoicing, according to economies, which have introduced it, is that it enables real-time monitoring for developing and maintaining fair business environments that in turn fortify the countries’ efforts on financial crimes and shadow economy. With complete data analytics, authorities can trace taxable transactions within an accuracy that eliminates the chances of tax fraud and significantly reduces the risk of financial misreporting.

5. Taxation process

E-invoicing finally simplifies and modernizes the tribute process instead of the traditional way it works nowadays. In cases of issuance and processing invoices, the traditional methods refer to long and tortuous erroneous procedures that make tax adherence an uphill task. Transitioning to the digital model made tax payments simpler for businesses in Saudi Arabia, such as filing accurate reports and timely payment of taxes. The overwhelming automated e-invoicing services become easily integrated with the e-filing interface system, thus streamlining reporting with less likelihood of human error. This, in turn, creates reliable income for the government and a conducive environment for business operations.

Conclusion

E-invoicing adoption is one of the most important deliveries of the Vision 2030 program for Saudi Arabia, as it lays the cornerstone of the new order, which benefits both businesses and the government by ushering in a financial efficiency-transparency. It allows reducing administrative costs and payment cycles and automates processes streaming, so it creates an environment in which businesses can push through to achieve their country’s broader economic goals. In addition to that, the move to e-invoicing sharpens the teeth of Saudi Arabia in anti-tax evasion and fraud, making the financial ecosystem of Saudi Arabia more dependable.

Apart from that, environmental and operational benefits further cement e-invoicing as one of the pillars of Saudi Arabia’s digital transformation. E-invoicing, by cutting down on paper use, therefore, addresses sustainability through global efforts to limit environmental footprint. While Saudi Arabia intensifies the momentum for digital and technological advances, e-invoicing will be indispensable for driving and modernizing growth strategies. Finally, e-invoicing will increase productivity and efficiency in tax compliance, while catapulting Saudi Arabia towards becoming a fast leader in the region and beyond in digital financial practices. This commitment underscores the nation’s readiness to leverage technology for a more efficient, secure, and eco-friendly economic future.

0 Comments